The Most Important Thing Illuminated Summary

Howard Marks is one of the most well-respected living value investors. Since 1990, he has been writing a public memo every few months that is widely read by many investors.

Howard Marks is one of the most well-respected living value investors. Since 1990, he has been writing a public memo every few months that is widely read by many investors.The Most Important Thing is a “best of” his letters with some additional color added. I found it imminently quotable and insightful. I would categorize Marks as a defensive value investor in the vein of Seth Klarman, Warren Buffet, or Mohnish Pabrai.

Quotes and Notes

It’s not my goal to simplify the act of investing. In fact, the thing I most want to make clear is just how complex it is. Those who try to simplify investing do their audience a great disservice.

“What have been the keys to your success?” My answer is simple: an effective investment philosophy, developed and honed over more than four decades and implemented conscientiously by highly skilled individuals who share culture and values.

“Experience is what you got when you didn’t get what you wanted.”

Most professional investors had joined the industry in the eighties or nineties and didn’t know a market decline could exceed 5 percent, the greatest drop seen between 1982 and 1999.

It’s not supposed to be easy. Anyone who finds it easy is stupid. CHARLIE MUNGER

An investment approach may work for a while, but eventually the actions it calls for will change the environment, meaning a new approach is needed.

Notes: 1) eg moving from Mediocristan to Extremistan.

investing is at least as much art as it is science, it’s never my goal—in this book or elsewhere—to suggest it can be routinized. In fact, one of the things I most want to emphasize is how essential it is that one’s investment approach be intuitive and adaptive rather than be fixed and mechanistic.

Since other investors may be smart, well-informed and highly computerized, you must find an edge they don’t have. You must think of something they haven’t thought of, see things they miss or bring insight they don’t possess. You have to react differently and behave differently. In short, being right may be a necessary condition for investment success, but it won’t be sufficient. You must be more right than others … which by definition means your thinking has to be different.

Second-level thinking is deep, complex and convoluted. The second-level thinker takes a great many things into account:

• What is the range of likely future outcomes?

• Which outcome do I think will occur?

• What’s the probability I’m right?

• What does the consensus think?

• How does my expectation differ from the consensus?

• How does the current price for the asset comport with the consensus view of the future, and with mine?

• Is the consensus psychology that’s incorporated in the price too bullish or bearish? • What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

Before trying to compete in the zero-sum world of investing, you must ask yourself whether you have good reason to expect to be in the top half. To outperform the average investor, you have to be able to outthink the consensus. Are you capable of doing so? What makes you think so?

CHRISTOPHER DAVIS: You can also invert this—in addition to asking yourself how and why you should succeed, ask yourself why others fail. Is there a problem with their time horizons? Are their incentive systems flawed or inappropriate?

The problem is that extraordinary performance comes only from correct nonconsensus forecasts, but nonconsensus forecasts are hard to make, hard to make correctly and hard to act on.

Notes: 1) hard to act on is underappreciated truth

In theory there’s no difference between theory and practice, but in practice there is. YOGI BERRA

it’s not easy for any one person—working with the same information as everyone else and subject to the same psychological influences—to consistently hold views that are different from the consensus and closer to being correct.

Notes: 1) it is hard to maintain an idiosyncratic view

some asset classes are quite efficient. In most of these:

• the asset class is widely known and has a broad following;

• the class is socially acceptable, not controversial or taboo;

• the merits of the class are clear and comprehensible, at least on the surface; and • information about the class and its components is distributed widely and evenly.

Second-level thinkers know that, to achieve superior results, they have to have an edge in either information or analysis, or both. They are on the alert for instances of misperception. My son Andrew is a budding investor, and he comes up with lots of appealing investment ideas based on today’s facts and the outlook for tomorrow. But he’s been well trained. His first test is always the same: “And who doesn’t know that?”

second-level thinkers depend on inefficiency. The term inefficiency came into widespread use over the last forty years as the counterpoint to the belief that investors can’t beat the market. To me, describing a market as inefficient is a high-flown way of saying the market is prone to mistakes that can be taken advantage of.

the assumptions that underlie the theory of efficient markets:

• There are many investors hard at work.

• They are intelligent, diligent, objective, motivated and well equipped.

• They all have access to the available information, and their access is roughly equal.

• They’re all open to buying, selling or shorting (i.e., betting against) every asset.

A narrow focus leads to potentially superior knowledge. But concentration of effort within rigid boundaries leaves a strong possibility of mispricings outside those borders. Also, if others’ silos are similar to your own, competitive forces will likely drive down returns in spite of superior knowledge within such silos.

For every person who gets a good buy in an inefficient market, someone else sells too cheap. One of the great sayings about poker is that “in every game there’s a fish. If you’ve played for 45 minutes and haven’t figured out who the fish is, then it’s you.” The same is certainly true of inefficient market investing.

Notes: 1) what do you know that the person on the other side of this trade does not?

investors should look for markets or assets that are not fully efficiently priced rather than chase after the false god of completely inefficient markets.

Why should a bargain exist despite the presence of thousands of investors who stand ready and willing to bid up the price of anything that’s too cheap?

• If the return appears so generous in proportion to the risk, might you be overlooking some hidden risk?

• Why would the seller of the asset be willing to part with it at a price from which it will give you an excessive return?

• Do you really know more about the asset than the seller does?

• If it’s such a great proposition, why hasn’t someone else snapped it up?

Many of the best bargains at any point in time are found among the things other investors can’t or won’t do.

“if something cannot go on forever, it will stop.”

In general, the upside potential for being right about growth is more dramatic, and the upside potential for being right about value is more consistent.

Notes: 1) Is there a way to do both? a smaller portfolio on growth that is the barbell and value for the center of the barbell. This is adventur.es play.

The first is something most investors don’t think about enough: fear of looking wrong. Like participants in any field requiring the application of skill under challenging circumstances, superior investors’ batting averages will be well below 1.000 and marked by errors and slumps.

Notes: 1) Every trade ends with regret

Investors with no knowledge of (or concern for) profits, dividends, valuation or the conduct of business simply cannot possess the resolve needed to do the right thing at the right time.

Notes: 1) You have to know why you are buying

no asset is so good that it can’t become a bad investment if bought at too high a price. And there are few assets so bad that they can’t be a good investment when bought cheap enough.

there’s nothing better than buying from someone who has to sell regardless of price during a crash.

JOEL GREENBLATT: For an individual investor this means that if you have invested too much in the market or in a particular investment and you can’t take the pain during periods of downside volatility,

The discipline that is most important is not accounting or economics, but psychology.

Investing is a popularity contest, and the most dangerous thing is to buy something at the peak of its popularity.

The biggest losers—be they Nifty-Fifty stocks in 1969, Internet stocks in 1999, or mortgage vehicles in 2006—had something in common: no one could find a flaw. There are lots of ways to describe this condition: “priced for perfection,” “on the pedestal of popularity,” and “nothing can go wrong.” Nothing’s perfect, however, and everything eventually turns out to have flaws. When you pay for perfection, you don’t get what you expected, and the high price you pay exposes you to risk of loss when reality comes to light. This is truly one of the riskiest things.

The safest and most potentially profitable thing is to buy something when no one likes it. Given time, its popularity, and thus its price, can only go one way: up.

A “top” in a stock, group or market occurs when the last holdout who will become a buyer does so. The timing is often unrelated to fundamental developments.

Buying at the right price is the hard part of the exercise.

Notes: 1) The money is made on the buy

The riskiest things: The most dangerous investment conditions generally stem from psychology that’s too positive. For this reason, fundamentals don’t have to deteriorate in order for losses to occur; a downgrading of investor opinion will suffice. High prices often collapse of their own weight.

Theory says high return is associated with high risk because the former exists to compensate for the latter. But pragmatic value investors feel just the opposite: They believe high return and low risk can be achieved simultaneously by buying things for less than they’re worth. In the same way, overpaying implies both low return and high risk.

“the relation between different kinds of investments and the risk of loss is entirely too indefinite, and too variable with changing conditions, to permit of sound mathematical formulation.”

Notes: 1) Risk is illegible. Has to be managed by fingerspitzengefuhl

Skillful investors can get a sense for the risk present in a given situation. They make that judgment primarily based on (a) the stability and dependability of value and (b) the relationship between price and value.

There have been many efforts of late to make risk assessment more scientific. Financial institutions routinely employ quantitative “risk managers” separate from their asset management teams and have adopted computer models such as “value at risk” to measure the risk in a portfolio. But the results produced by these people and their tools will be no better than the inputs they rely on and the judgments they make about how to process the inputs. In my opinion, they’ll never be as good as the best investors’ subjective judgments.

Notes: 1) Tacit vs explicit knowledge. Fingerspitz.

“There’s a big difference between probability and outcome. Probable things fail to happen—and improbable things happen—all the time.”

investment performance is what happens when a set of developments—geopolitical, macro-economic, company-level, technical and psychological—collide with an extant portfolio. Many futures are possible, to paraphrase Dimson, but only one future occurs. The future you get may be beneficial to your portfolio or harmful, and that may be attributable to your foresight, prudence or luck.

Many things could have happened in each case in the past, and the fact that only one did happen understates the variability that existed.

People overestimate their ability to gauge risk and understand mechanisms they’ve never before seen in operation. In theory, one thing that distinguishes humans from other species is that we can figure out that something’s dangerous without experiencing it. We don’t have to burn ourselves to know we shouldn’t sit on a hot stove. But in bullish times, people tend not to perform this function. Rather than recognize risk ahead, they tend to overestimate their ability to understand how new financial inventions will work.

Notes: 1) I have never lived through a bear market so its not clear how I will perform.

The received wisdom is that risk increases in the recessions and falls in booms. In contrast, it may be more helpful to think of risk as increasing during upswings, as financial imbalances build up, and materializing in recessions. ANDREW CROCKETT

Risk means uncertainty about which outcome will occur and about the possibility of loss when the unfavorable ones do.

participating when prices are high rather than shying away is the main source of risk.

Notes: 1) Nothing wrong with sitting on the sidelines.

A good analogy to this is the studies that show there are more traffic fatalities among drivers and passengers in SUVs than in compact cars despite SUVs’ being bigger and more sturdily built. Drivers of SUVs believe they’re not at risk in case of an accident, and this leads to riskier driving. The feeling of safety tends to increase risk while the awareness of risk tends to reduce it.

So a prime element in risk creation is a belief that risk is low, perhaps even gone altogether. That belief drives up prices and leads to the embrace of risky actions despite the lowness of prospective returns.

Notes: 1) Things are riskiest when everyone is overconfident.

things: A few times in my career, I’ve seen the rise of a belief that risk has been banished, cycles won’t occur any longer, or the laws of economics have been suspended. The experienced, risk-conscious investor takes this as a sign of great danger.

Notes: 1) This is happening in crypto

carefree, unworried investors are their own worst enemy.

Notes: 1) Only the paranoid survive.

because investors believed too much, worried too little and thus took too much risk. In short, they believed they were living in a low-risk world.

Notes: 1) Overestimating risk makes things safer

Worry and its relatives, distrust, skepticism and risk aversion, are essential ingredients in a safe financial system.

Investment risk comes primarily from too-high prices, and too-high prices often come from excessive optimism and inadequate skepticism and risk aversion. Contributing underlying factors can include low prospective returns on safer investments, recent good performance by risky ones, strong inflows of capital, and easy availability of credit.

Notes: 1) All of these things are true in 2017

People vastly overestimate their ability to recognize risk and underestimate what it takes to avoid it; thus, they accept risk unknowingly and in so doing contribute to its creation.

rising fear and risk aversion combine to widen risk premiums at the same time as they reduce risk.

Notes: 1) When investors are afraid is the best time to buy

When everyone believes something is risky, their unwillingness to buy usually reduces its price to the point where it’s not risky at all.

when everyone believes something embodies no risk, they usually bid it up to the point where it’s enormously risky.

Notes: 1) Compounded by incentives of money managers who don’t want to look dumb.

This paradox exists because most investors think quality, as opposed to price, is the determinant of whether something’s risky.

Notes: 1) Nothing is good at any price but almost anything can be good at a low enough prrice.

high quality assets can be risky, and low quality assets can be safe.

Whatever few awards are presented for risk control, they’re never given out in good times. The reason is that risk is covert, invisible. Risk—the possibility of loss—is not observable. What is observable is loss, and loss generally happens only when risk collides with negative events.

An inefficient market can also allow a skilled investor to achieve the same return as the benchmark while taking less risk, and I think this is a great accomplishment

good years in the market, risk-conscious investors must content themselves with the knowledge that they benefited from its presence in the portfolio, even though it wasn’t needed.

Notes: 1) You have to think about risk adjusted return in good years. Maybe your return was lower but so was your risk.

Bearing risk unknowingly can be a huge mistake, but it’s what those who buy the securities that are all the rage and most highly esteemed at a particular point in time—to which “nothing bad can possibly happen”—repeatedly do.

Notes: 1) The more people believe a stock is risk-less thee riskier it is.

Risky assets can make for good investments if they’re cheap enough. The essential element is knowing when that’s the case. That’s it: the intelligent bearing of risk for profit, the best test for which is a record of repeated success over a long period of time.

Even if we realize that unusual, unlikely things can happen, in order to act we make reasoned decisions and knowingly accept that risk when well paid to do so. Once in a while, a “black swan” will materialize. But if in the future we always said, “We can’t do such-and-such, because the outcome could be worse than we’ve ever seen before,” we’d be frozen in inaction. So in most things, you can’t prepare for the worst case. It should suffice to be prepared for once-in-a-generation events. But a generation isn’t forever, and there will be times when that standard is exceeded. What do you do about that? I’ve mused in the past about how much one should devote to preparing for the unlikely disaster. Among other things, the events of 2007–2008 prove there’s no easy answer.

Notes: 1) Great point. My thinking is that you can distribute things along a continuum where a very small percentage is prepping for disaster black swans then incrementally larger for more common but lower magnitude events. Basically, size your positions according to the likelihod x impact or EV

I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.

there are two concepts we can hold to with confidence: • Rule number one: most things will prove to be cyclical. • Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.

Notes: 1) Be greedy when others are fearful and fearful when others are greedy.

“the worst loans are made at the best of times.”

This belief that cyclicality has been ended exemplifies a way of thinking based on the dangerous premise that “this time it’s different.” These four words should strike fear—and perhaps suggest an opportunity for profit—for anyone who understands the past and knows it repeats.

Notes: 1) Things do change but we tend to over or under estimate them. Things are never as good or as bad as thry seem. The 08 collapse and subsequent bull market are more extreme as Taleb predicted but they are not apocayptic. Allocation and thinking should change based on Taleb’s thesis but not totally abandoned

The mood swings of the securities markets resemble the movement of a pendulum. Although the midpoint of its arc best describes the location of the pendulum “on average,” it

actually spends very little of its time there. Instead, it is almost always swinging toward or away from the extremes of its arc. But whenever the pendulum is near either extreme, it is inevitable that it will move back toward the midpoint sooner or later. In fact, it is the movement toward an extreme itself that supplies the energy for the swing back.

Hallmark of bubbles is a dearth of risk aversion.

I’ve recently boiled down the main risks in investing to two: the risk of losing money and the risk of missing opportunity. It’s possible to largely eliminate either one, but not both. In an ideal world, investors would balance these two concerns.

In 2005, 2006 and early 2007, with things going so swimmingly and the capital markets wide open, few people imagined that losses could lie ahead. Many believed risk had been banished. Their only worry was that they might miss an opportunity; if Wall Street came out with a new financial miracle and other investors bought and they didn’t—and if the miracle worked—they might look unprogressive and lose ground. Since they weren’t concerned about losing money, they didn’t insist on low purchase prices, adequate risk premiums or investor protection. In short, they behaved too aggressively. • Then in late 2007 and 2008, with the credit crisis in full flower, people began to fear a complete meltdown of the world financial system. No one worried about missing opportunity; the pendulum had swung to the point where people worried only about losing money. Thus, they ran from anything with a scintilla of risk—regardless of the potential return—and to the safety of government securities with yields near zero. At this point, then, investors feared too much, sold too eagerly and positioned their portfolios too defensively.

Notes: 1) I feel like I am reasonably predisposed to be fearful when others are greedy but I also need to be greedy when others are fearful. It’s likely that there will not be an end of the world scenario in the next market crash and I should invest heavily.

Then, when there’s chaos all around and assets are on the bargain counter, they lose all willingness to bear risk and rush to sell. And it will ever be so.

Notes: 1) The barbell helps avoid this because you have a cash cushion. Same with emergency funds.

the three stages of a bull market. Now I’ll share them with you.

• The first, when a few forward-looking people begin to believe things will get better

• The second, when most investors realize improvement is actually taking place

• The third, when everyone concludes things will get better forever

the three stages of a bear market:

• The first, when just a few thoughtful investors recognize that, despite the prevailing bullishness, things won’t always be rosy

• The second, when most investors recognize things are deteriorating

• The third, when everyone’s convinced things can only get worse

Major bottoms occur when everyone forgets that the tide also comes in. Those are the times we live for.

The swing back from the extreme is usually more rapid—and thus takes much less time—than the swing to the extreme. (Or as my partner Sheldon Stone likes to say, “The air goes out of the balloon much faster than it went in.”)

Notes: 1) Negative lack swans happen faster than positive black swans

The occurrence of this pendulum-like pattern in most market phenomena is extremely dependable. But just like the oscillation of cycles, we never know: • how far the pendulum will swing in its arc, • what might cause the swing to stop and turn back,

The desire for more, the fear of missing out, the tendency to compare against others, the influence of the crowd and the dream of the sure thing—-these factors are near universal. Thus they have a profound collective impact on most investors and most markets. The result is mistakes, and those mistakes are frequent, widespread and recurring.

Why do mistakes occur? Because investing is an action undertaken by human beings, most of whom are at the mercy of their psyches and emotions.

CHRISTOPHER DAVIS: And not only their psyches and emotions—perverse incentives can influence institutional investors’ decision making in negative ways.

Notes: 1) Mistakes are psychological and incentive driven not intellectual in most cases

The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.

Emotion and ego: Psychological influences have great power over investors. Most succumb, permitting investor psychology to determine the swings of the market. When those forces push markets to extremes of bubble or crash, they create opportunities for superior investors to augment their results by refusing to hold at the highs and by insisting on buying at the lows. Resisting the inimical forces is an absolute requirement.

Notes: 1) One good way to resist is to not be overexposed or over leveraged so you feel comfortable taking risks.

The combination of greed and optimism repeatedly leads people to pursue strategies they hope will produce high returns without high risk; pay elevated prices for securities that are in vogue; and hold things after they have become highly priced in the hope there’s still some appreciation left. Afterwards, hindsight shows everyone what went wrong: that expectations were unrealistic and risks were ignored.

Notes: 1) Definitely true in crypto right now.

“Nothing is easier than self-deceit. For what each man wishes, that he also believes to be true.”

The belief that some fundamental limiter is no longer valid—and thus historic notions of fair value no longer matter—is invariably at the core of every bubble and consequent crash.

the process of investing requires a strong dose of disbelief. … Inadequate skepticism contributes to investment losses. Time and time again, the postmortems of financial debacles include two classic phrases: “It was too good to be true” and “What were they thinking?”

When the same or closely similar circumstances occur again, sometimes in only a few years, they are hailed by a new, often youthful, and always supremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.

JOEL GREENBLATT: Many of the mistakes I have made are the same ones that I had made before; they just look a little different each time—the same mistake slightly disguised.

Notes: 1) Keep a decision journal and look for patterns

No strategy can produce high rates of return without risk. And nobody has all the answers; we’re all just human. Markets are highly dynamic, and, among other things, they function over time to take away the opportunity for unusual profits. Unskeptical belief that the silver bullet is at hand eventually leads to capital punishment.

What makes for belief in silver bullets? First, there’s usually a germ of truth. JOEL GREENBLATT: Remember, if theories (like rumors) didn’t have this germ of truth, no one would have believed them in the first place. It’s spun into an intelligent-sounding theory, and adherents get on their soapboxes to convince others. Then it produces profits for a while, whether because there’s merit in it or just because buying on the part of new converts lifts the price of the subject asset.

Notes: 1) Crypto will be a huge deal but hyperbitcoinization or similar will take decades to play out if it ever happens.

“Like the participants in Solomon Asch’s visual experiments in the 1950s,” Cassidy writes, “many people who don’t share the consensus view of the market start to feel left out. Eventually, it reaches a stage where it appears the really crazy people are those not in the market.”

Notes: 1) As soon as the pension funds get in then I am out.

greed might be, always spurring people to strive for more and more, the impact is even stronger when they compare themselves to others. This is one of the most harmful aspects of what we call human nature. People who might be perfectly happy with their lot in isolation become miserable when they see others do better. In the world of investing, most people find it terribly hard to sit by and watch while others make more money than they do.

Notes: 1) NYC exacerbates this. Perhaps one of Buffett’s advantages.

SETH KLARMAN: Even the best investors judge themselves on the basis of return. It would be hard to evaluate yourself on risk, since risk cannot be measured. Apparently, the risk-averse managers of this endowment were disappointed with their relative returns even though their risk-adjusted performance was likely excellent, as borne out by their performance over the following three years. This highlights just how hard it is to maintain conviction over the long run when short-term performance is considered poor.

Notes: 1) Is there some way to asses risk subjectively to analyze risk adjusted returns? Problem is you are likely to lie to yourself and believe real risk is low when it’s actually high and vice versa

Most institutional and individual investors benchmark their returns, and therefore most end up chasing the crowd: accent on the wrong sylLABle.

Notes: 1) Don’t benchmark yourself against others

thoughtful investors can toil in obscurity, achieving solid gains in the good years and losing less than others in the bad. They avoid sharing in the riskiest behavior because they’re so aware of how much they don’t know and because they have their egos in check. This, in my opinion, is the greatest formula for long-term wealth creation—but it doesn’t provide much ego gratification in the short run. It’s just not that glamorous to follow a path that emphasizes humility, prudence and risk control.

HOWARD MARKS: Fear of looking wrong: Assets become overpriced because of investor behavior that overrates their merit and carries them aloft. This process shouldn’t be expected to come to a halt when the price has risen to the “right” level or when you’ve sold it because you feel it’s priced too high. Usually, the freight train rumbles on quite a bit further, and price judgments are much more likely to look wrong at first than right. Although understandable, this can be very hard to live with.

tech bubble. Earlier I mentioned that crazy time as evidence of what happens when investors disregard the need for a reasonable relationship between value and price. What is it that causes them to abandon common sense? Some of the same emotions we have been talking about here: greed, fear, envy, self-deceit, ego. Let’s review the scenario and watch psychology at work. The 1990s were a very strong period for stocks. There were bad days and months, of course, and traumas such as a big jump in interest rates in 1994, but Standard & Poor’s 500 stock index showed a gain every year from 1991 through 1999 inclusive, and its return averaged 20.8 percent per year. Those results were enough to put investors in an optimistic mood and render them receptive to bullish stories. Growth stocks performed a bit better than value stocks in the early part of the decade—perhaps as a rebound from value’s outperformance in the 1980s. This, too, increased investors’ willingness to highly value companies’ growth potential. Investors became enthralled by technological innovation. Developments such as broadband, the Internet and e-commerce seemed likely to change the world, and tech and telecom entrepreneurs were lionized. Tech stocks appreciated, attracting more buying, and this led to further appreciation, in a process that as usual took on the appearance of an unstoppable virtuous circle. Logical-seeming rationales play a part in most bull markets, and this one was no different: tech stocks will outperform all other stocks because of the companies’ excellence. More tech names will be added to the equity indices, reflecting their growing importance in the economy. This will require index funds and the “closet indexers” who covertly emulate indices to buy more of them, and active investors will buy to keep up as well. More people will create 401(k) retirement plans, and 401(k) investors will increase the representation of stocks in their portfolios and the allocation to tech stocks among their stocks. For these reasons, tech stocks (a) must keep appreciating and (b) must outpace other stocks. Thus they’ll attract still more buying. The fact that all of these phenomena actually occurred for a while lent credence to this theory. Initial public offerings of technology stocks began to appreciate by tens and even hundreds of percent on the day of issue and took on the appearance of sure winners. Gaining access to IPOs became a popular mania. From the perspective of psychology, what was happening with IPOs is particularly fascinating. It went something like this: The guy next to you in the office tells you about an IPO he’s buying. You ask what the company does. He says he doesn’t know, but his broker told him it’s going to double on the day of issue. So you say that’s ridiculous. A week later he tells you it didn’t double … it tripled. And he still doesn’t know what it does. After a few more of these, it gets hard to resist. You know it doesn’t make sense, but you want…

Notes: 1) So parallel to crypto in 2018

HOWARD MARKS: Emotion and ego: Refusing to join in the errors of the herd—like so much else in investing—requires control over psyche and ego. It’s the hardest thing, but the payoff can be enormous. Mastery over the human side of investing isn’t sufficient for success, but combining it with analytical proficiency can lead to great results.

Notes: 1) Therapy is a good ROI investment

What weapons might you marshal on your side to increase your odds? Here are the ones that work for Oaktree: • a strongly held sense of intrinsic value, JOEL GREENBLATT: Without this, an investor has no home base. A strong sense of intrinsic value is the only way to withstand the psychological influences that affect behavior. Those who can’t value companies or securities have no business investing and limited prospects (other than luck) for investing successfully. This sounds simple, but plenty of investors lack it. • insistence on acting as you should when price diverges from value, • enough conversance with past cycles—gained at first from reading and talking to veteran investors, and later through experience—to know that market excesses are ultimately punished, not rewarded, • a thorough understanding of the insidious effect of psychology on the investing process at market extremes, • a promise to remember that when things seem “too good to be true,” they usually are, • willingness to look wrong while the market goes from misvalued to more misvalued (as it invariably will), and • like-minded friends and colleagues from whom to gain support (and for you to support).

To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit. SIR JOHN TEMPLETON

buy when they hate ’em, and sell when they love ’em. “Once-in-a-lifetime” market extremes seem to occur once every decade or so—not often enough for an investor to build a career around capitalizing on them. But attempting to do so should be an important component of any investor’s approach.

Even when an excess does develop, it’s important to remember that “overpriced” is incredibly different from “going down tomorrow.” • Markets can be over- or underpriced and stay that way—or become more so—for years. • It can be extremely painful when the trend is going against you.

If you look to the markets for a report card, owning a stock that declines every day will make you feel like a failure. But if you remember that you own a fractional interest in a business and that every day you are able to buy in at a greater discount to underlying value, you might just be able to maintain a cheerful disposition. This is exactly how Warren Buffett describes bargain hunting amid the ravages of the 1973 to 1974 bear market.

It can appear at times that “everyone” has reached the conclusion that the herd is wrong. What I mean is that contrarianism itself can appear to have become too popular, and thus contrarianism can be mistaken for herd behavior.

Notes: 1) I think thats happening now

You must do things not just because they’re the opposite of what the crowd is doing, but because you know why the crowd is wrong. Only then will you be able to hold firmly to your views and perhaps buy more as your positions take on the appearance of mistakes and as losses accrue rather than gains.

Notes: 1) You need a clear thesis and a sufficiently diversified portfolio to ride out bear markeys

Investment success requires sticking with positions made uncomfortable by their variance with popular opinion. Casual commitments invite casual reversal, exposing portfolio managers to the damaging whipsaw of buying high and selling low. Only with the confidence created by a strong decision-making process can investors sell speculative excess and buy despair-driven value.

Fear of looking wrong: The very words used here—uninstitutional, idiosyncratic, imprudent, lonely, and uncomfortable—provide an idea of how challenging it is to maintain nonconsensus positions. But doing so is an absolute must if superior performance is to be achieved.

Notes: 1) Most people are bad investors bc they are afraid of looking wrong

What’s clear to the broad consensus of investors is almost always wrong. … The very coalescing of popular opinion behind an investment tends to eliminate its profit potential.

Notes: 1) Its already priced in

in dealing with the future, we must think about two things: (a) what might happen and (b) the probability that it will happen. During the crisis, lots of bad things seemed possible, but that didn’t mean they were going to happen. In times of crisis, people fail to make that distinction. …

Notes: 1) I have a tendency to thibk too worst case. Eg. I probably would not have bought stocks in 08 bc I was afraid market would disappear.this should be handled with portfolio allocation. You have a tail event allocation and so you invest the rest knowing that is covered

Lots of bad things happened to kick off the credit crisis that had been considered unlikely (if not impossible), and they happened at the same time, to investors who’d taken on significant leverage.

Notes: 1) Punctuated Equilibrium

But that triggered an epiphany: skepticism and pessimism aren’t synonymous. Skepticism calls for pessimism when optimism is excessive. But it also calls for optimism when pessimism is excessive.

Skepticism is usually thought to consist of saying, “no, that’s too good to be true” at the right times. But I realized in 2008—and in retrospect it seems so obvious—that sometimes skepticism requires us to say, “no, that’s too bad to be true.”

a hugely profitable investment that doesn’t begin with discomfort is usually an oxymoron.

The process of intelligently building a portfolio consists of buying the best investments, making room for them by selling lesser ones, and staying clear of the worst. The raw materials for the process consist of

(a) a list of potential investments

(b) estimates of their intrinsic value

(c) a sense for how their prices compare with their intrinsic value,

(d) an understanding of the risks involved in each, and of the effect their inclusion would have on the portfolio being assembled.

Notes: 1) I should put this into my SOP in some way

Our goal isn’t to find good assets, but good buys. Thus, it’s not what you buy; it’s what you pay for it.

and return high relative to risk? In other words, what makes something sell cheaper than it should?

• Unlike assets that become the subject of manias, potential bargains usually display some objective defect. An asset class may have weaknesses, a company may be a laggard in its industry, a balance sheet may be over-levered, or a security may afford its holders inadequate structural protection.

• Since the efficient-market process of setting fair prices requires the involvement of people who are analytical and objective, bargains usually are based on irrationality or incomplete understanding. Thus, bargains are often created when investors either fail to consider an asset fairly, or fail to look beneath the surface to understand it thoroughly, or fail to overcome some non-value-based tradition, bias or stricture.

• Unlike market darlings, the orphan asset is ignored or scorned. To the extent it’s mentioned at all by the media and at cocktail parties, it’s in unflattering terms.

SETH KLARMAN: Generally, the greater the stigma or revulsion, the better the bargain.

• Usually its price has been falling, making the first-level thinker ask, “Who would want to own that?” (It bears repeating that most investors extrapolate past performance, expecting the continuation of trends rather than the far-more-dependable regression to the mean. First-level thinkers tend to view past price weakness as worrisome, not as a sign that the asset has gotten cheaper.) • As a result, a bargain asset tends to be one that’s highly unpopular. Capital stays away from it or flees, and no one can think of a reason to own it.

Notes: 1) I like this idea of a barbell portfolio. Eg. Really boring businesses and crypto

Our goal is to find underpriced assets. Where should we look for them? A good place to start is among things that are: • little known and not fully understood; • fundamentally questionable on the surface; • controversial, unseemly or scary; • deemed inappropriate for “respectable” portfolios; • unappreciated, unpopular and unloved; • trailing a record of poor returns; and • recently the subject of disinvestment, not accumulation.

To boil it all down to just one sentence, I’d say the necessary condition for the existence of bargains is that perception has to be considerably worse than reality.

Notes: 1) This is David’s thing of looking for liquidity crises. Everyone is too bearish.

Later in 1978, I was asked to start a fund for high yield bonds. These low-rated securities, burdened with the unpleasant sobriquet junk bonds, fell short of most investing institutions’ minimum requirement of “investment grade or better” or “single-A or better.” Junk bonds might default, so how could they possibly be appropriate holdings for pension funds or endowments?

Notes: 1) Find stuff that institutions cant touch for reputational reasons.

A great clue to these securities’ potential could be found in one rating agency’s description of B-rated bonds as “generally lacking the characteristics of a desirable investment.” By now you should be quick to ask how anyone could issue a blanket dismissal of a potential class of investments without any reference to price. SETH KLARMAN: More broadly, this is the problem with all agency ratings. The supposed safety attracts investors who fail to do their own homework, making them the ultimate buyers of conventional wisdom. Ironically, ratings downgrades typically occur long after the markets have figured out that a problem exists, leaving investors who trusted the ratings with large losses.

Notes: 1) Look for poorly rated stock

This is one of the hardest things to master for professional investors: coming in each day for work and doing nothing.

Notes: 1) This is why its good to have another biz

Still, calibration is important. Set the bar too high and you might remain out of the market for a very long time. Set it too low and you will be fully invested almost immediately; it will be as though you had no standards at all. Experience and versatile thinking are the keys to such calibration.

Notes: 1) I’ve made this mistake. This is what portfolio mgmt is for. Its not all or nothing.

If they miss too many opportunities, and if their returns are too low in good times, money managers can come under pressure from clients and eventually lose accounts. A lot depends on how clients have been conditioned.

Notes: 1) If you arent managing anyones money then this is a big advantage. You dont have any pressure. Can also be a disadvantage if it keeps you out of the market forever

• Hold cash—but that’s tough for people who need to meet an actuarial assumption or spending rate; who want their money to be “fully employed” at all times; or who’ll be uncomfortable (or lose their jobs) if they have to watch for long as others make money they don’t. SETH KLARMAN: In recent years, holding cash is so completely out of favor that it has become the ultimate contrarian investment.

You want to take risk when others are fleeing from it, not when they’re competing with you to do so.

May 2005 wasn’t the perfect time to get off the merry-go-round; May 2007 was. Being early provided a good reminder about the pain involved in being too far ahead of your time. Having said that, it was much better to get off too soon in May 2005 than to stay on past May 2007.

The key during a crisis is to be (a) insulated from the forces that require selling and (b) positioned to be a buyer instead.

PAUL JOHNSON: Although extremely challenging to follow, this is excellent advice. To satisfy those criteria, an investor needs the following things: staunch reliance on value, little or no use of leverage, long-term capital and a strong stomach.

We have two classes of forecasters: Those who don’t know—and those who don’t know they don’t know. JOHN KENNETH GALBRAITH

It’s frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what’s going on. AMOS TVERSKY

There are two kinds of people who lose money: those who know nothing and those who know everything. HENRY KAUFMAN

One way to get to be right sometimes is to always be bullish or always be bearish; if you hold a fixed view long enough, you may be right sooner or later. And if you’re always an outlier, you’re likely to eventually be applauded for an extremely unconventional forecast that correctly foresaw what no one else did. But that doesn’t mean your forecasts are regularly of any value.

Notes: 1) I should be autious of always being bearish for this reason.

Ask yourself how many forecasters correctly predicted the subprime problem, global credit crisis and massive meltdown of 2007–2008. You might be able to think of a few, and you might conclude that their forecasts were valuable. But then ask yourself how many of those few went on to correctly foresee the economic recovery that started slowly in 2009 and the massive market rebound that year. I think the answer’s “very few.” And that’s not an accident. Those who got 2007–2008 right probably did so at least in part because of a tendency toward negative views. As such, they probably stayed negative for 2009. The overall usefulness of those forecasts wasn’t great … even though they were partially right about some of the most momentous financial events in the last eighty years.

Notes: 1) I tend bearish so I should know that and bias against that

One key question investors have to answer is whether they view the future as knowable or unknowable. Investors who feel they know what the future holds will act assertively: making directional bets, concentrating positions, levering holdings and counting on future growth—in other words, doing things that in the absence of foreknowledge would increase risk. On the other hand, those who feel they don’t know what the future holds will act quite differently: diversifying, hedging, levering less (or not at all), emphasizing value today over growth tomorrow, staying high in the capital structure, and generally girding for a variety of possible outcomes. The first group of investors did much better in the years leading up to the crash. But the second group was better prepared when the crash unfolded, and they had more capital available (and more-intact psyches) with which to profit from purchases made at its nadir.

Notes: 1) Be greedy whn others are fearful and fearful when others are greedy.

It would be wonderful to be able to successfully predict the swings of the pendulum and always move in the appropriate direction, but this is certainly an unrealistic expectation. I consider it far more reasonable to try to (a) stay alert for occasions when a market has reached an extreme, (b) adjust our behavior in response and, (c) most important, refuse to fall into line with the herd behavior that renders so many investors dead wrong at tops and bottoms.

So look around, and ask yourself: Are investors optimistic or pessimistic? Do the media talking heads say the markets should be piled into or avoided? Are novel investment schemes readily accepted or dismissed out of hand? Are securities offerings and fund openings being treated as opportunities to get rich or possible pitfalls? Has the credit cycle rendered capital readily available or impossible to obtain? Are price/earnings ratios high or low in the context of history, and are yield spreads tight or generous? PAUL JOHNSON: These insightful questions can easily act as a checklist that investors could use periodically to take the market’s temperature.

Notes: 1) Questions for determining where we are in the cycle

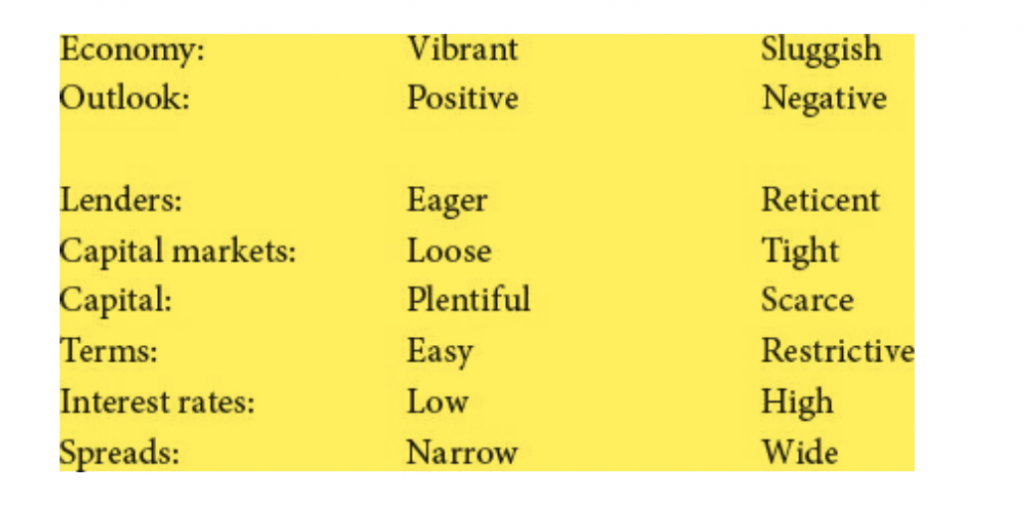

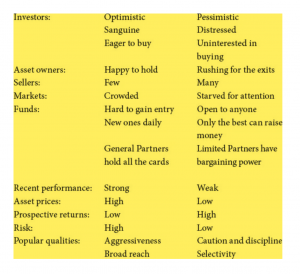

THE POOR MAN’S GUIDE TO MARKET ASSESSMENT Here’s a simple exercise that might help you take the temperature of future markets. I have listed a number of market characteristics. For each pair, check off the one you think is most descriptive of today. And if you find that most of your checkmarks are in the left-hand column, as I do, hold on to your wallet.

This is why it is all-important to look not at investors’ track records but at what they are doing to achieve those records. Does it make sense? Does it appear replicable? Why haven’t competitive forces priced away any apparent market inefficiencies that enabled this investment success?

What is a good decision? Let’s say someone decides to build a ski resort in Miami, and three months later a freak blizzard hits south Florida, dumping twelve feet of snow. In its first season, the ski area turns a hefty profit. Does that mean building it was a good decision? No. A good decision is one that a logical, intelligent and informed person would have made under the circumstances as they appeared at the time, before the outcome was known.

We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important to ensure survival under negative outcomes than it is to guarantee maximum returns under favorable ones.

Notes: 1) Avoid risk of ruin

There are old investors, and there are bold investors, but there are no old bold investors.

even highly skilled investors can be guilty of mis-hits, and the overaggressive shot can easily lose them the match. Thus, defense—significant emphasis on keeping things from going wrong—is an important part of every great investor’s game.

Oaktree portfolios are set up to outperform in bad times, and that’s when we think outperformance is essential. Clearly, if we can keep up in good times and outperform in bad times, we’ll have above-average results over full cycles with below-average volatility, and our clients will enjoy outperformance when others are suffering.

Notes: 1) Makes sense

There are two principal elements in investment defense. The first is the exclusion of losers from portfolios. This is best accomplished by conducting extensive due diligence, applying high standards, demanding a low price and generous margin for error (see later in this chapter) and being less willing to bet on continued prosperity, rosy forecasts and developments that may be uncertain. The second element is the avoidance of poor years and, especially, exposure to meltdown in crashes. In addition to the ingredients described previously that help keep individual losing investments from the portfolio, this aspect of investment defense requires thoughtful portfolio diversification, limits on the overall riskiness borne, and a general tilt toward safety.

There are lots of forms of financial activity that reasonably can be expected to work on average, but they might give you one bad day on which you melt down because of a precarious structure or excess leverage.

Notes: 1) On average doeesnt matter if you risk ruin. No risk of ruin

“Because ensuring the ability to survive under adverse circumstances is incompatible with maximizing returns in the good times, investors must choose

The critical element in defensive investing is what Warren Buffett calls “margin of safety” or “margin for error.”

I don’t think many investment managers’ careers end because they fail to hit home runs. Rather, they end up out of the game because they strike out too often—not because they don’t have enough winners, but because they have too many losers.

Notes: 1) Lots of margin of safety

The cautious seldom err or write great poetry.

Notes: 1) This is why the barbell makes sense to me. Becautious with 80% and risky with remaining

Caution can help us avoid mistakes, but it can also keep us from great accomplishments.

Many people seem unwilling to do enough of anything (e.g., buy a stock, commit to an asset class or invest with a manager) such that it could significantly harm their results if it doesn’t work. But in order for something to be able to materially help your return if it succeeds, you have to do enough so that it could materially hurt you if it fails.

HOWARD MARKS: Fear of looking wrong: This dilemma shows how the fear of looking wrong interferes with implementing judgments and how hard it is to be a successful investor if you’re worried about appearances. Investment committees that behave “institutionally” do so for the simple reason that the pain associated with looking wrong is too great to bear. But the bottom line is simple and absolutely true: if you’re dominated by an unwillingness to be wrong, you’ll never be able to adopt the lonely, contrarian positions required for serious investment success.

Notes: 1) Ive had this problem in the past. I need to be willing to be wrong publicly while still having a margin of safety internlly.

Worry about the possibility of loss. Worry that there’s something you don’t know. Worry that you can make high-quality decisions but still be hit by bad luck or surprise events. Investing scared will prevent hubris; will keep your guard up and your mental adrenaline flowing; will make you insist on an adequate margin of safety; and will increase the chances that your portfolio is prepared for things going wrong. And if nothing does go wrong, surely the winners will take care of themselves.

I think of the sources of error as being primarily analytical/intellectual or psychological/emotional. The former are straightforward: we collect too little information or incorrect information.

Another important pitfall—largely psychological, but important enough to constitute its own category—is the failure to recognize market cycles and manias and move in the opposite direction.

Thus, it’s important to return to Bruce Newberg’s pithy observation about the big difference between probability and outcome. Things that aren’t supposed to happen do happen. Short-run outcomes can diverge from the long-run probabilities, and occurrences can cluster. For example, double sixes should come up once in every 36 rolls of the dice. But they can come up five times in a row—and never again in the next 175 rolls—and in the long run have occurred as often as they’re supposed to.

Notes: 1) Dice game analogy is wrong because events are connected

The financial crisis occurred largely because never-before-seen events collided with risky, levered structures that weren’t engineered to withstand them.

Notes: 1) Leverage makes you fragile

There’s always a rational—perhaps even a sophisticated—explanation of why some eighth wonder of the world will work in the investor’s favor. However, the explainer usually forgets to mention that (a) the new phenomenon would represent a departure from history, (b) it requires things to go right, (c) many other things could happen instead and (d) many of those might be disastrous.

What We Learn from a Crisis—or Ought To

• Too much capital availability makes money flow to the wrong places.

• When capital goes where it shouldn’t, bad things happen.

• When capital is in oversupply, investors compete for deals by accepting low returns and a slender margin for error.

• Widespread disregard for risk creates great risk. “Nothing can go wrong.” “No price is too high.” “Someone will always pay me more for it.” “If I don’t move quickly, someone else will buy it.”

• Inadequate due diligence leads to investment losses.

• In heady times, capital is devoted to innovative investments, many of which fail the test of time.

• Hidden fault lines running through portfolios can make the prices of seemingly unrelated assets move in tandem.

A portfolio may appear to be diversified as to asset class, industry and geography, but in tough times, nonfundamental factors such as margin calls, frozen markets and a general rise in risk aversion can become dominant, affecting everything similarly.

• Psychological and technical factors can swamp fundamentals.

• Markets change, invalidating models. Accounts of the difficulties of “quant” funds center on the failure of computer models and their underlying assumptions. The computers that run portfolios attempt primarily to profit from patterns that held true in past markets. They can’t predict changes in those patterns; they can’t anticipate aberrant periods; and thus they generally overestimate the reliability of past norms.

Notes: 1) Taleb

Most of these eleven lessons can be reduced to just one: be alert to what’s going on around you with regard to the supply/demand balance for investable funds and the eagerness to spend them.

Failure to do so was the great error of the crisis. Leading up to it, what could investors have done? The answers lay in

• taking note of the carefree, incautious behavior of others

• preparing psychologically for a downturn

• selling assets, or at least the more risk-prone ones

• reducing leverage

• raising cash (and returning cash to clients if you invested for others), and

• generally tilting portfolios toward increased defensiveness.

human nature causes defensive investors and their less traumatized clients to derive comfort in down markets when they lose less than others. This has two very important effects. First, it enables them to maintain their equanimity and resist the psychological pressures that often make people sell at lows. Second, being in a better frame of mind and better financial condition, they are more able to profit from the carnage by buying at lows. Thus, they generally do better in recoveries.

One way to improve investment results—which we try hard to apply at Oaktree—is to think about what “today’s mistake” might be and try to avoid it. There are times in investing when the likely mistake consists of:

• not buying,

• not buying enough,

• not making one more bid in an auction,

• holding too much cash,

• not using enough leverage, or

• not taking enough risk.

I don’t think that describes 2004. I’ve always heard that no one awaiting heart surgery ever complained, “I wish I’d gone to the office more.” Well, likewise I don’t think anyone in the next few years is going to look back and say, “I wish I’d invested more in 2004.” Rather, I think this year’s mistake is going to turn out to be:

• buying too much,

• buying too aggressively,

• making one bid too many,

• using too much leverage, and

• taking too much risk in the pursuit of superior returns.

When investor psychology is at equilibrium and fear and greed are balanced, asset prices are likely to be fair relative to value. In that case there may be no compelling action, and it’s important to know that, too. When there’s nothing particularly clever to do, the potential pitfall lies in insisting on being clever.

Here’s how I describe Oaktree’s performance aspirations: In good years in the market, it’s good enough to be average. Everyone makes money in the good years, and I have yet to hear anyone explain convincingly why it’s important to beat the market when the market does well. No, in the good years average is good enough. There is a time, however, when we consider it essential to beat the market, and that’s in the bad years. Our clients don’t expect to bear the full brunt of market losses when they occur, and neither do we.

many investment firms raise a large amount of assets as a result of a good long-term record. With more capital, managers are often forced to invest differently than they did when they were building their great track record.

no investment activity is likely to be successful unless the return goal is (a) explicit and (b) reasonable in the absolute and relative to the risk entailed. Every investment effort should begin with a statement of what you’re trying to accomplish. The key questions are what your return goal is, how much risk you can tolerate, and how much liquidity you’re likely to require in the interim.

if an economist or strategist offers a sure-to-be-right view of the future, you should wonder why he or she is still working for a living, since derivatives can be used to turn correct forecasts into vast profits without requiring much capital.

“The perfect is the enemy of the good.” This is especially applicable to investing, where insisting on participating only when conditions are perfect—for example, buying only at the bottom—can cause you to miss out on a lot. Perfection in investing is generally unobtainable; the best we can hope for is to make a lot of good investments and exclude most of the bad ones.

Notes: 1) You either buy too early, too late, too much or not enough. You can only bee wrong. You just want to be less wrong.

How does Oaktree resolve the question of knowing when to buy? We give up on trying to attain perfection or ascertain when the bottom has been reached. Rather, if we think something is cheap, we buy. If it gets cheaper, we buy more. And if we commit all our capital, we assume we’ll be able to raise more.

I need 8 percent. I’d be glad to earn 10 percent instead. Twelve percent would be even better. But I won’t try for more than that, because doing so would entail risks I’m just not willing to bear. I don’t need 20 percent. I encourage you to think about “good-enough returns.” It’s essential to realize that there are returns so high that they aren’t worth going for and risks that aren’t worth taking.

The best foundation for a successful investment—or a successful investment career—is value. You must have a good idea of what the thing you’re considering buying is worth.

To achieve superior investment results, your insight into value has to be superior. Thus you must learn things others don’t, see things differently or do a better job of analyzing them—ideally, all three.

Your view of value has to be based on a solid factual and analytical foundation, and it has to be held firmly. Only then will you know when to buy or sell.

Notes: 1) Problem with buying on tips is you have no idea when to sell because you have not thesis

the psychology of the investing herd moves in a regular, pendulum-like pattern—from optimism to pessimism; from credulousness to skepticism; from fear of missing opportunity to fear of losing money; and thus from eagerness to buy to urgency to sell. The swing of the pendulum causes the herd to buy at high prices and sell at low prices. Thus, being part of the herd is a formula for disaster, whereas contrarianism at the extremes will help to avert losses and lead eventually to success.

Notes: 1) For all the markets you are in, what is the psychology?

“What the wise man does in the beginning, the fool does in the end.”

Buying based on strong value, low price relative to value, and depressed general psychology is likely to provide the best results. Even then, however, things can go against us for a long time before turning as we think they should. Underpriced is far from synonymous with going up soon. Thus the importance of my second key adage: “Being too far ahead of your time is indistinguishable from being wrong.”

They have to go well beyond the academics’ singular definition of risk as volatility and understand that the risk that matters most is the risk of permanent loss. They have to reject increased risk bearing as a surefire formula for investment success and know that riskier investments entail a wider range of possible outcomes and a higher probability of loss. They have to have a sense for the loss potential that’s present in each investment and be willing to bear it only when the reward is more than adequate.

“If we avoid the losers, the winners will take care of themselves,”

Margin for error is a critical element in defensive investing. Whereas most investments will be successful if the future unfolds as hoped, it takes margin for error to render outcomes tolerable when the future doesn’t oblige. An investor can obtain margin for error by insisting on tangible, lasting value in the here and now; buying only when price is well below value; eschewing leverage; and diversifying. Emphasizing these elements can limit your gains in good times, but it will also maximize your chances of coming through intact when things don’t go well. My third favorite adage is “Never forget the six-foot-tall man who drowned crossing the stream that was five feet deep on average.” Margin for error gives you staying power and gets you through the low spots.

Thus, in the good years, defensive investors have to be content with the knowledge that their gains, although perhaps less than maximal, were achieved with risk protection in place …

Many investors—amateurs and professionals alike—assume the world runs on orderly processes that can be mastered and predicted. They ignore the randomness of things and the probability distribution that underlies future developments. Thus, they opt to base their actions on the one scenario they predict will unfold. This works sometimes—winning kudos for the investor—but not consistently enough to produce long-term success. In both economic forecasting and investment management, it’s worth noting that there’s usually someone who gets it exactly right … but it’s rarely the same person twice. The most successful investors get things “about right” most of the time, and that’s much better than the rest.

Notes: 1) Potrfolio mgmt should reflect epistimic certainty or lack thereof

Neither defensive investors who limit their losses in a decline nor aggressive investors with substantial gains in a rising market have proved they possess skill. For us to conclude that investors truly add value, we have to see how they perform in environments to which their style isn’t particularly well suited.

Last Updated on June 7, 2025 by Taylor Pearson