Communities can maintain themselves based on intimate acquaintance up to groups of about 150 people, often referred to as Dunbar’s number.1

However, once a group passes this number, social dynamics change. You can’t run a thousand-person business the same way you run a one hundred-person business. You can’t run a one hundred-person business the same way you run a ten-person business. And you can’t run a ten-person business the same way you you run a two-person business.

Nation-states, religions, and corporations all manage to function at even larger scales without intimate acquaintance. If you see someone you don’t know walking down the street, you don’t feel compelled to bash them over the head with a club for self defence.

Why not? The secret to how this cooperation at larger scales functions appears to be shared myths (used here as powerful, defining stories which create shared understanding – not as fictions). These are the necessary glue which bind any large-scale human cooperative endeavour together.

These shared myths need not be formalized into a syllabus.

In most areas of human coordination they rarely are. No one in high school formally decides and dictates what is “cool,” yet everyone somehow knows what (and who) is cool.

Myths, Shared stories and understanding, are understood by individuals inside the group, but members outside of a group often can’t make any sense of them. Many of us had embarrassing moments in high school when our parents did something distinctly “uncool,” oblivious to the shared myths of our school.

It made no objective sense to my parents that I would spend $300 to get a Flowmaster exhaust kit installed on my truck.

It made perfect sense to me. There was a myth that all the cool kids in the Memphis suburbs got flowmasters. I was trying (and failing) to signal that I was one of the cool kids.

While these shared myths may seem like just a silly aspect of high school, they exist in every functional community. It’s important to understand them, because signalling them effectively helps us access better opportunities within a community.

This seems stupid in the context of high school – trying to be cool in high school doesn’t do much for you after high school.

But understanding the shared myths of a community of customers you are selling to matters quite a lot. If you do understand them, your business grows, if you don’t your business dies.

We often express this understanding of shared myths by saying, “they just get it.”

If you have five designers do a mockup for your website redesign, for example, you can look at the mock-ups and say that one of them “gets it” better than others, without understanding much about design.

What you’re saying, in essence, is that they have understood, and expressed in their design, the myths you believe in.

Internet businesses and entrepreneurship, like high school, have their shared myths. If you understand the shared myths of a group, you gain an intuitive understanding of what you can and cannot do. You gain or lose access to opportunities accordingly.

Before understanding these shared myths, you are a bit like your parents were when you were in high school—you unknowingly commit faux pas.

After you understand these shared myths, you “get it.”

People often ask for reading recommendations, so I put together seven essays that capture the most important shared myths of internet business.

1. “1,000 True Fans” by Kevin Kelly

The 1,000 true fans myth is this: to be a successful creator in the internet era, you don’t need millions of fans. You need 1,000 true fans.

It is perhaps the foundational myth of internet business.

I worked with a company whose main product was a specialized piece of industrial equipment. About 400 people per month searched for that piece of equipment on Google. It cost about $400.

How much money can you make selling a product which only 400 people in the entire U.S. ( precisely 0.000125431% of the U.S. population and probably less people than you had in your high school) search for each month?

Millions of dollars.

The math behind 1,000 true fans shows how. A true fan is anyone who will spend at least $100 per year buying what you make. They buy the hardcover and audio versions of your book and the collector’s edition of your poster release each year.

Because the internet enables you to have a direct relationship with your fans, they buy directly from you, not a bookstore or Procter & Gamble, and you get to keep all one hundred of those dollars.

That’s $100,000 per year––a pretty good living for most people. 1,000 true fans is a lot more feasible to attain than a million fans. If you convince one person to become a true fan every day, it will take you three years to get there.

You can play with the math. 400 people per month buying a $400 piece of equipment is $1,920,000.

What Kevin Kelly’s essay shows is that in the internet era, most businesses are built not by aiming at the masses, but by aiming at the niches. Even the largest internet-era companies started with very small niches: Facebook was just for Harvard undergrads (about 6,700 people) and Paypal was just for Ebay powersellers (of which there were less than 20,000 at the time).

How many products are there which 1,000 people per year would spend $100 on?

A lot.

This hasn’t always been true, of course. The economics of 1,000 true fans don’t work if you are Procter & Gamble selling Tide detergent. You need millions or at least hundreds of thousands of customers to get shelf space in Walmart and Target.

How many people will pay $100/year for gluten-free, fairtrade, organic certified detergent? Not many, and that’s just fine.

Find your 1,000 true fans and don’t worry about the millions.

2. “How To Make Wealth” by Paul Graham

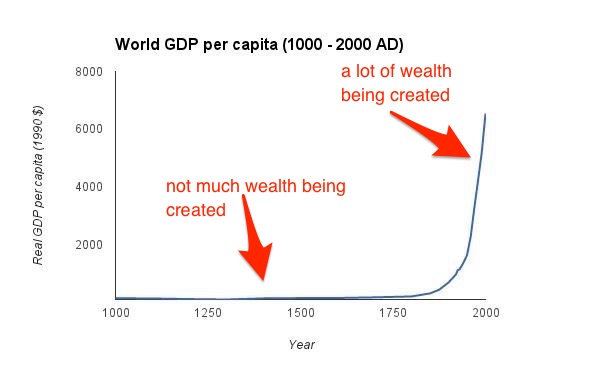

One of the shared myths that underlies most people’s worldview is that wealth is zero sum. Why?

For the great majority of human history, this was true. The Catholic Church outlawed usury (the loaning of money at interest) because it mostly seemed to just redistribute wealth and not create more of it.

Graham’s essay points out that we conflate wealth with money. Money is not wealth––it’s just something we use to move wealth around.

He shows that wealth is simply what you want. Imagine you have a magic machine that could create anything you wanted on demand. Plane tickets to the Caribbean? Poof. A hot cup of coffee? Poof. A brand-new Tesla? Poof.

As long as you had this magic machine, would you care how much money you had?

What software makes clear is that individuals have more ability than ever to shape the future. Economic numbers only hint at the profundity of the societal impact of software and the internet.

As a simple example, a 14-year-old teenager today (too young to show up in labor statistics) can learn programming, contribute significantly to open-source projects, and become a talented professional-grade programmer before age 18.2

You can sit down in front of a computer and create wealth.

3. “Do Things That Don’t Scale” by Paul Graham

A lot of would-be entrepreneurs believe that products either take off or they don’t.

You make something available and if it’s good, then people will beat a path to your door. If they don’t, it means that the market doesn’t exist.

This myth is unhelpful and does not seem to play out. The reality is that even if you make something amazing, you need to spend at least 50 per cent, if not 80 per cent of your energy in the first few years “doing things that don’t scale” in order to sell it.

Graham tells the story of Stripe, the online payments company which is now valued in the billions of dollars. Stripe was started by a few hundred instances of a “Collison installation.”

The founders, Patrick and John Collison, would ask friends in coffee shops or bars, “Will you try our beta version?” If they said yes, they didn’t do what most founders do and send them a link the next day. They immediately said, “Give me your laptop,” and set it up on the spot.

Most would-be entrepreneurs would think, “There is no way this scales” and give up. They don’t understand that most internet companies start very very small and “Collison install” their way to 1,000 true fans.

It seems most effective to think in terms of orders of ten. If you have zero customers, you only need to figure out how to get to 10. You can do that by asking friends in coffee shops. Once you have ten, you only need to figure out how to get to one hundred. You can probably do that with phone or emails or LinkedIn messages (or even a lot of coffee shops).

Read Do Things That Don’t Scale

4. “Principles” by Ray Dalio (Sections 1 and 2)

Ray Dalio is the founder of Bridgewater, the most successful hedge fund in history. That’s like being the greatest NFL player in the U.S. or the best football/soccer player in Europe. It’s probably the most competitive industry with the smartest people in the world over the past few decades, and his track record is the best.

His most fundamental principle?

“Truth––more precisely, an accurate understanding of reality––is the essential foundation for producing good outcomes.”

While this seems obvious, it’s only very recently become an accurate statement for startups and online business

If you were part of a hunter-gatherer tribe that deeply believed in the rain dance, you should do the rain dance. Even if you had good reason to believe that the rain dance wasn’t really working, it was probably best to keep believing in the rain dance anyway, or at least keep your mouth shut.

If you brought forward the truth, that the rain dance doesn’t work, you got a bad outcome: everyone thinks you’re a heretic, you get thrown out of the tribe, and die.

Going against the Roman Emperor, Medieval Pope, or English King when you felt they were wrong was about as good an idea as denying the rain dance worked.

In the early 20th century, John Maynard Keynes was not wrong in saying that, ““Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally.”

Even in today’s world, this is often true. There are lots of people working in companies and institutions who think the system is a complete mess, but they’re five years away from retirement or their big bonus, so they are better off just riding it out. They get a good outcome by confirming lies, not by seeking the truth.

For internet businesses or startups, this is never the case. 3

Like hedge fund managers, internet entrepreneurs subscribe to the maxim of “strong views, weakly held.” They act decisively on their current beliefs, but are quick to revise those beliefs when new information presents itself. 4

Read Principles by Ray Dalio (Or pre-order the book)

5. “Elementary Worldly Wisdom” by Charlie Munger

Charlie Munger is something of a business zen master. He speaks infrequently and softly, but when he does, you should listen. Charlie is Warren Buffett’s silent partner at Berkshire-Hathaway which makes him worth a cool $1.5 billion.

In 1994, he gave a speech to USC’s business school on Elementary Worldly Wisdom.

What is Charlie’s elementary worldly wisdom? The first rule is that you don’t really know anything if you only know isolated facts and can repeat them back. You have to have a latticework of models in your head to hang those facts on, and those models come from reading and working in a wide range of disciplines.

Without those models, you are like a man with a hammer who assumes that every problem is a nail.

Munger’s promise is that there are only “80 or 90 important models [that] will carry about 90% of the freight in making you a worldly-wise person.”

You can learn to use these models, he argues, the same way a golfer can learn to swing a club or a tennis player a racket.

The first time you play tennis or gold and “swing naturally,” you won’t get good results.

You have to learn to hold the club with a certain grip, and swing in a way that at first feels unnatural, to realize your full potential as a tennis player or golfer.

The first time you encounter a difficult problem and “think naturally,” you won’t get good results either.

If you don’t build these elementary, but unnatural, models, you are doomed to go through life like a “one-legged man in an ass-kicking contest.”

The ability to build that latticework is greater today than at any point in history. Thanks to the internet, there are more brilliant autodidacts alive today than ever before.

Read Elementary Worldly Wisdom

6. Helsinki Bus Station Theory by Arno Rafael Minkkinen

There is a bus station in Helsinki, Finland. Some two dozen platforms are laid out in a square at the heart of the city and each platform has a sign with the numbers of the buses that leave from that platform. Let’s say you’re at a platform with three buses leaving: the 21, 71, and 58.

You get on the 21. All three buses stop at the same three first stops. Metaphorically speaking, let’s say that each stop represents a year in your career.

You get to the third stop and look around to realize that everyone else is at the same stop––your work and their work look exactly alike. Shocked, you realize that what you’ve been working on for three years has already been done.

So you hop off the bus, grab a cab back to the bus station and look for another bus. You repeat the same process. Maybe at first you were in UI design and you move to marketing. Three years into your marketing career, you realize your stuff is the same as everyone else’s.

So you hop off and go back to the bus station. This goes on forever.

What should you do? Stay on the bus.

Why? Because if you do, you will start to see a difference. The buses that move out of Helsinki stay on the same line, but only for three stops or so. Then they begin to separate and each heads on its own unique path. The 21 goes north and the 71 goes southwest.

Suddenly, your work is unique and starts to get noticed.

Ira Glass, the host of the now-iconic podcast and radio show This American Life, echoed the lessons in an interview:

“All of us who do creative work, we get into it because we have good taste. But there is this gap. For the first couple years you make stuff, it’s just not that good. It’s trying to be good, it has potential, but it’s not. But your taste, the thing that got you into the game, is still killer. And your taste is why your work disappoints you. A lot of people never get past this phase, they quit. Most people I know who do interesting, creative work went through years of this. We know our work doesn’t have this special thing that we want it to have. We all go through this. And if you are just starting out or you are still in this phase, you gotta know its normal and the most important thing you can do is do a lot of work.”

Read The Helsinki Bus Station Theory

7. “Aggregation Theory” by Ben Thompson

The value chain for any market is divided into three parts: suppliers, distributors, and consumers/users.

In the pre-Internet era, the best way to make money was to control suppliers and distribution. This was true across every industry.

Newspapers integrated suppliers (reporters writing content) with distribution (trucks delivering newspapers).

Taxi companies integrated suppliers (taxi drivers with medallions) with distribution (dispatchers answering calls telling the drivers where to go to make money).

Consumers were mostly an afterthought. If you didn’t like your local newspaper or taxi company, tough luck.

The internet has flipped this on its head. The most successful internet businesses integrate distribution with consumers and leave suppliers as an afterthought.

Facebook controls the platform for reaching users and so suppliers (newspapers and other publishers, as well as advertisers) have to live with their rules.

Uber and Lyft modularized supply by working with independent drivers and integrating dispatch with customer management.

The most important factor for success on the internet is user experience.

The best distributors providing the best experience earn the most consumers/users, which attracts more suppliers, which enhances the user experience in a virtuous cycle.

The Internet Business Entrepreneur’s Imperative

In aggregate, the internet entrepreneur’s imperative is something like:

You can create wealth by making something a very few people want very badly. You do this by focusing obsessively on your customer’s experience.

At first, you must tell them about this thing in a very manual, unscalable way.

In order to survive as the business grows, you must ruthlessly seek out truth by building a latticework of models from many different fields and always asking “Am I right? Is this true?”

Getting rich will take longer than you can imagine, but shorter than you can bear. Don’t get off the bus.

Last Updated on June 7, 2025 by Taylor Pearson

Footnotes

- Dunbar’s original research places thresholds at 5, 15, 50, 150, 500, and 1500. That is, everytime group size roughly triples, the organizational structure has to change. Good further reading at The New Yorker and Ribbonfarm

- Breaking Smart Season 1 builds on this premise in more detail.

- I suspect this is why so many entrepreneurs read and follow finance. There is something about interacting with markets, both public and private, which is a wonderful bullshit filter. You can BS your way up many fields using politics, but not in the markets.

- To toss in another Paul Graham piece, the best ideas are often what you can’t say

This is really very good stuff Taylor, and I should be reflecting on how I can put these ideas to work, but I’ve found myself LOLing at the concept of Flowmasters instead.

haha, I’ll take it 🙂

This is epic high level stuff, now all I need is 1 day off to read and then a week off to soak it all in… (In hind sight I might need a year to soak it in)

I’m on 5 years and counting!

This is great : ) and the content upgrade. Loving it. I know it’s going to stay in my Pocket for ages to refer too. I’ve properly read about half of these but they all require regular reading for sure. Can you please add an affiliate link to the Flowmaster too? : 0

The best part about writing this was I got to re-read them myself 🙂

#Flowmaster4Life

The Catholic Church’s restrictions on usury are rooted in Aristotelian philosophy. Aristotle taught, as you have demonstrated, that money is sterile, and has no value, and, therefore, money being used to create more money, not only runs contrary to Natural Law, but is ultimately detrimental to the Common Good. The value of products and services in the marketplace should be grounded in human labor. The history of capitalism can best be described as a conflict between labor and usury.