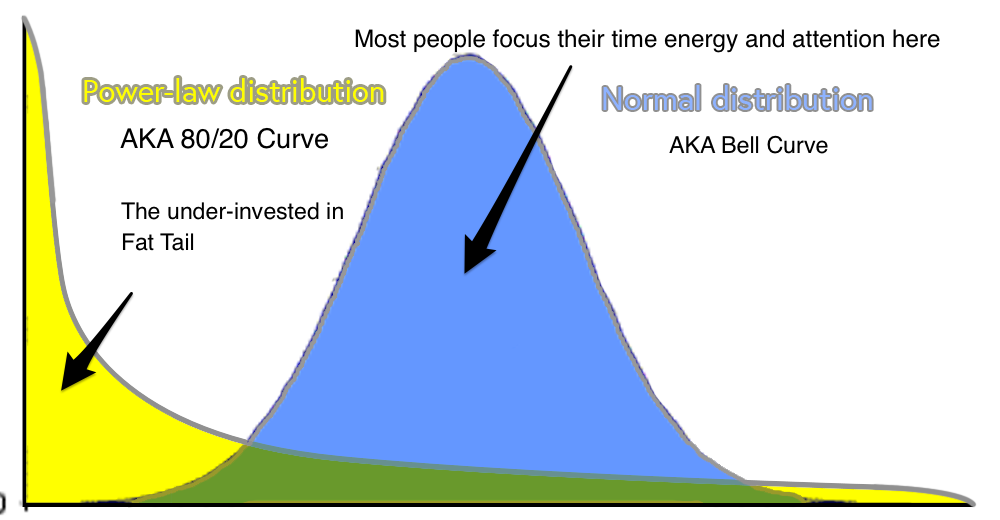

There are at least two overarching mental models for looking at the world: One could be called the bell curve and the other, the 80/20 curve.

When I was marketing my book, The End of Jobs, I spent a week sending personal emails (in Gmail, one by one, not in bulk) to two hundred people who I thought could potentially be in the top 1% of my readers, the people most excited about the book.

In total, I spent about 50% of my marketing resources on 1% of readers.

One of the two hundred people happened to have a friend who had a large community of people interested in business books.

He introduced us and his friend ended up emailing his community about the book, which drove it to #1 in Amazon’s business and money section.

Another of those two hundred people forwarded the book to a much larger “influencer” in my space, who ended up reading the book, inviting me on his podcast, and giving me a blurb.

Those two emails probably accounted for over half of my book’s sales.

You’re probably thinking “wow, great for you, you got lucky.”

It does sound like I know how to attract luck, doesn’t it?

What I want to argue is that if you see the world through the 80/20 curve, what happened to me was not lucky, but statistically probable. I’m suggesting that seemingly trite phrases like “luck is what happens when preparation meets opportunity” are supported by math.

Now, I know what you’re thinking right now: “Gee, I hope this essay has LOTS AND LOTS OF GRAPHS!”

You’re in luck!

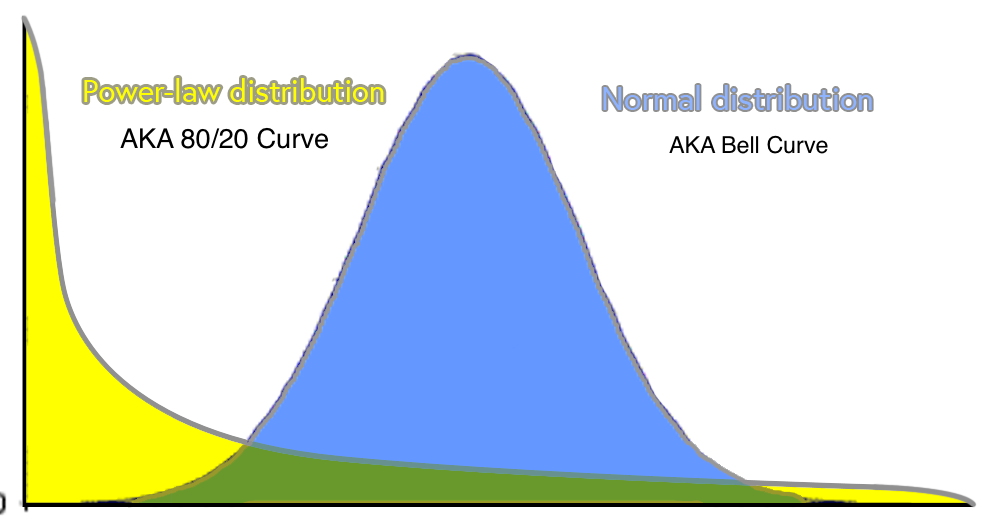

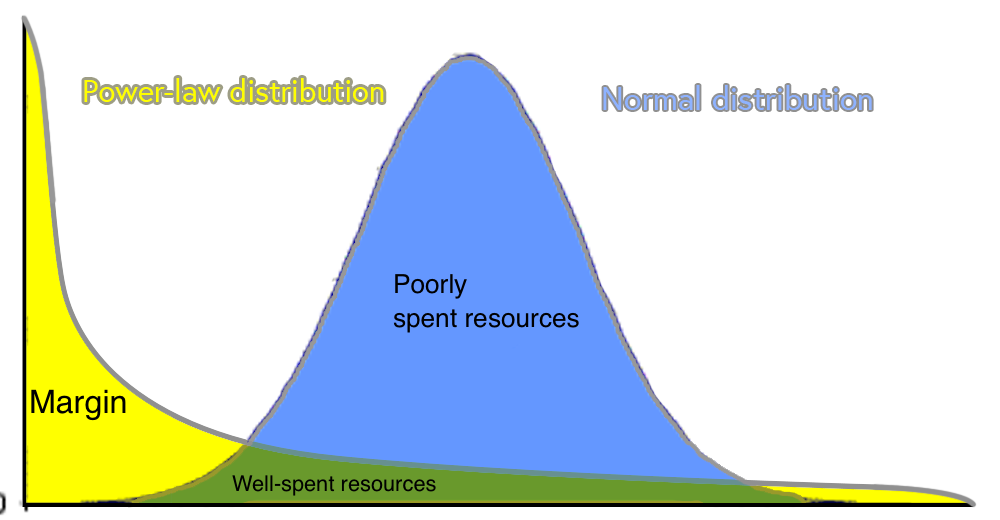

Here’s a graph of a bell curve (also called a normal distribution) and an 80/20 curve (also known as a power law curve).

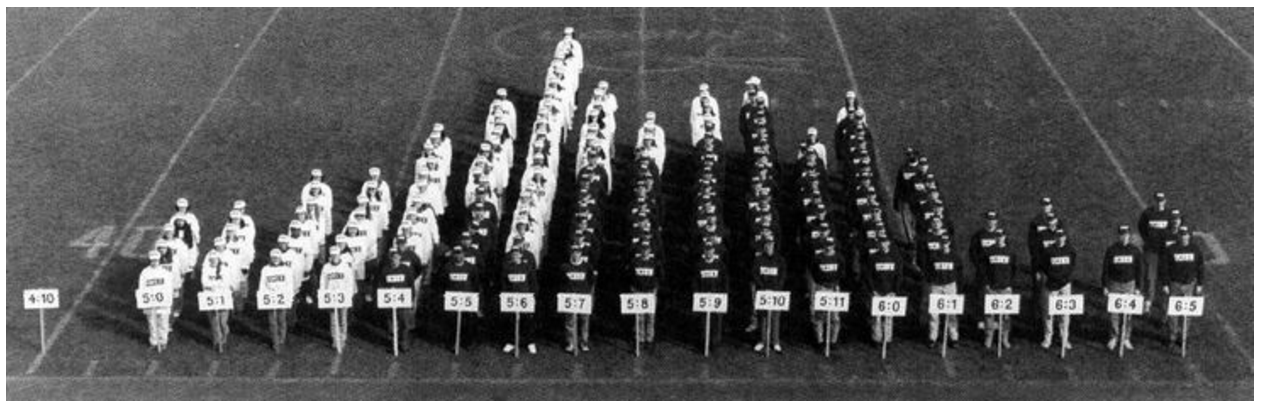

The Bell Curve is an accurate way to describe simple systems, particularly biological ones like height:

Most people fall in the middle, and it trails out slightly on each side.

However, as our world grows more complex and interdependent, the bell curve is a worse and worse way of describing the things that matter to us.

It’s now the 80/20 curve that defines our lives.

The 80/20 curve was first articulated by Vilfredo Pareto, an Italian economist, who found that 80% of the land in Italy was owned by only 20% of the people.

The phrase 80/20 can be confusing because people think it has to add up to 100, but that’s just incidental. Pareto’s central insight was that a small group owns a large portion of the land. It could be that in England 10% of people own 70% of the land, or that in America 5% of people own 81% of t-shirts, that 7% of people fly 53% of flights, or that 25% of products account for 90% of the revenue.

The 80/20 curve applies in any system when a small number of inputs account for a large percentage of outputs, which, as it turns out, is pretty much always.

What MBAs Can Learn from a Singer-Songwriter about how to attract luck

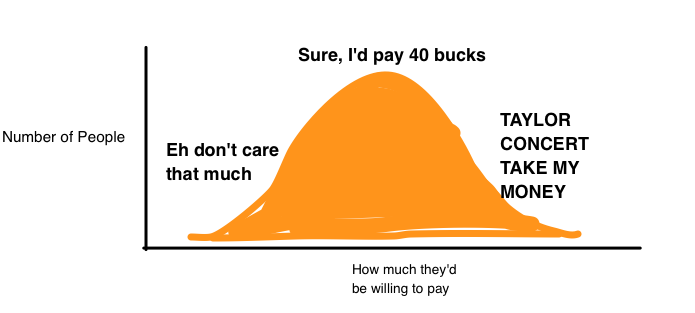

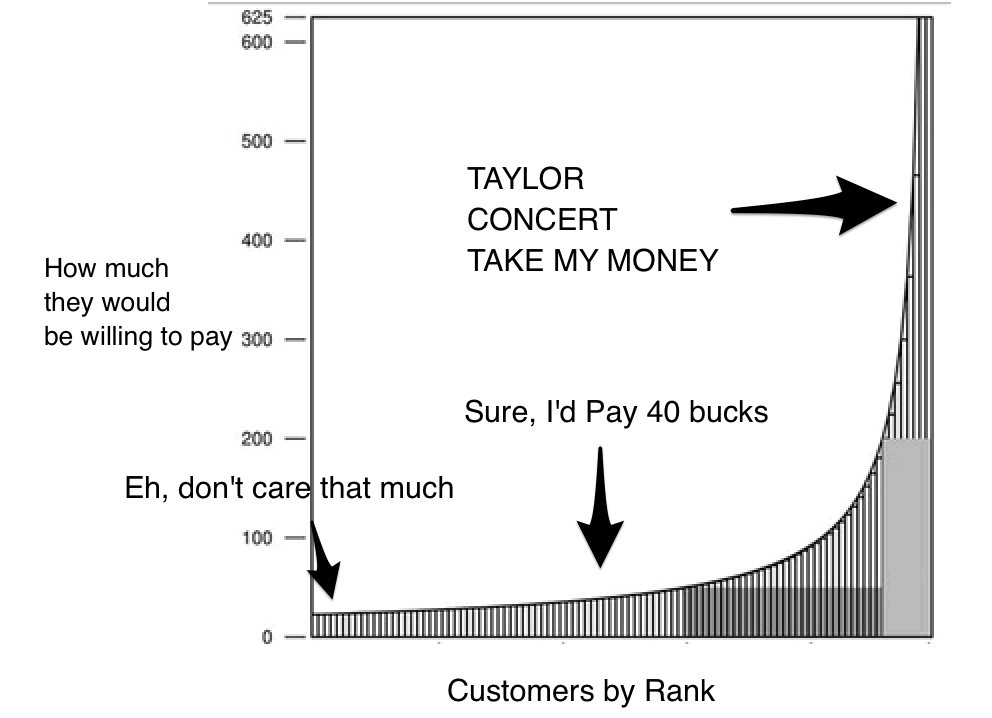

There’s a classic exercise often done in business schools that goes something like this: The professor walks into the room and says “I have two tickets to a Taylor Swift concert. Write down the most you’d be willing to pay for these tickets, then turn in your answers.” The professor then puts a bell curve up on the board that will, invariably, look something like below.

The professor then goes on to explain why Taylor Swift should price her tickets at around $40 (what most people are willing to pay), in order to maximize sales.1

Looking at that chart, this makes sense.

That’s what most people would say, and it’s what business people would say. It is the bell-curve-model-of-the-world answer.

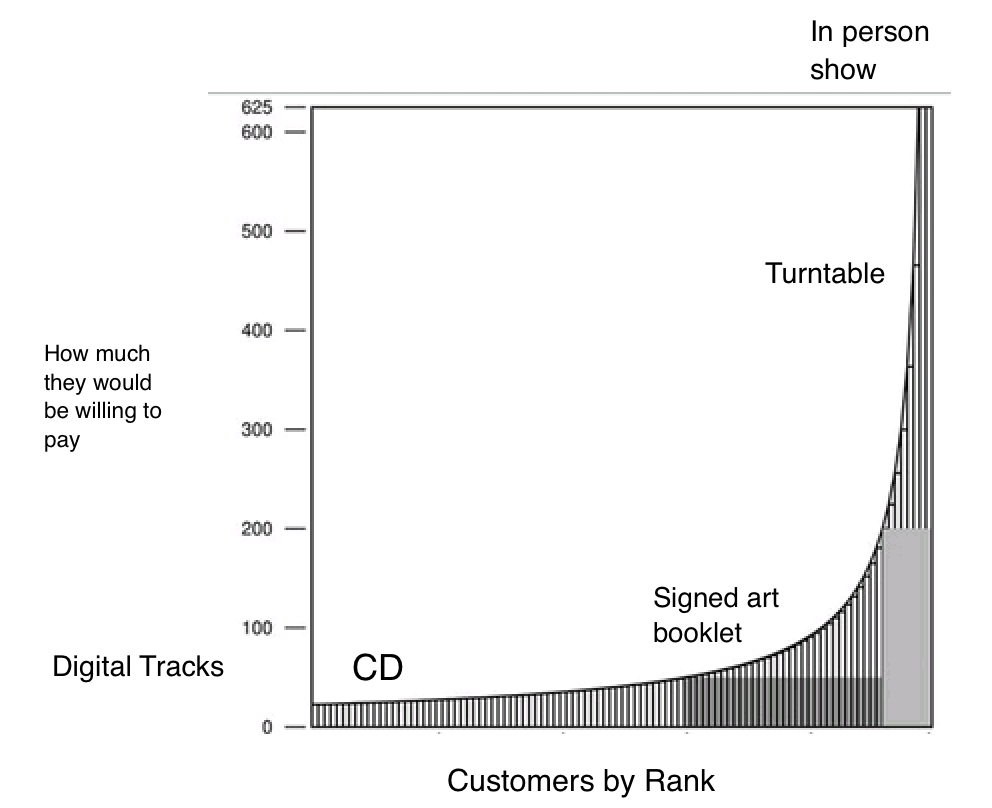

Let’s look at that exact same group of people through the lens of an 80/20 curve:

Source: 80/20 Sales and Marketing by Perry Marshall

This is the exact same group of people, but plotted on the 80/20 curve. Most people would pay about $40, a few people would pay much more, and a few people would prefer to use Taylor Swift’s CDs in their garden as a way to scare off birds.

What are the implications for a musical artist of seeing the world through the 80/20 curve, as opposed to a bell curve?

Luckily, we don’t have to speculate. There’s a real life example.

Amanda Palmer is an American singer-songwriter who rose to prominence as the lead of the Dresden Dolls.

In 2008 she went solo and released her first solo album, Who Killed Amanda Palmer. It sold about 36,000 copies.2 If we assume an average of around $15 per CD, the CD earned $540,000.

In 2012, she released her second solo album, Theatre is Evil. She released it on Kickstarter, had 24,000 backers pay to support the campaign and made $1.2 million dollars.

Woah, how did she make more than twice as much money ($1.2 million vs $540 thousand) by selling to less people (24,000 instead of 36,000)?

Everyone’s initial thought is that she would have had to charge $50 per CD to make that much, right?

Not right. Our intuitions, based on our bell curve model, deceive us.

She offered different price points along the 80/20 curve. You could get just the digital tracks for $1. You could get the CD and an art booklet for $25. You could get the same but with an autograph by Amanda for $100. You could get all of the above with a custom painted turntable for $500. For five grand, she would turn up and play a show in your backyard.

Because she looked at her fans through the lens of the 80/20 curve, she got a very different result:3 She earned more than three times as much money per customer ($50 vs $15).

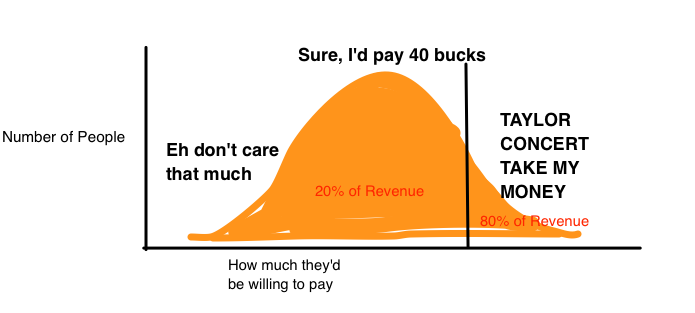

80/20 is striking to most people because it indicates that the natural order of most systems is not an equal distribution, but an unequal distribution: only 20% of customers account for 80% of revenue.

However, the disparities are even larger than most people think.

The really striking part is just how concentrated the “fat tail” of the curve is. The fat tail is the tall part on the right side of the 80/20 curve: it’s the people that paid for Amanda Palmer to come to their house, or whose first reaction to hearing about a Taylor Swift concert was “OMGGGG TAYLOR TAKE MY MONEY NOW.”

Why is it so concentrated? Because the 80/20 is fractal. That means it can be applied to itself. If 20% of people own 80% of the land, we can then take the 80/20 of that new 20%. In that case, 4% of people would own 64% of the land. If we then took the 80/20 of that, then 0.8% of people own 51.2% of the land.

That’s really concentrated! And this is true everywhere.

In the case of Amanda Palmer, she raised $316,000 in her Kickstarter (26%) from 184 backers (0.7%).

The graph of a bell curve is a poor fit with reality. What looks like the majority of people, is actually a minority of anything that matters. I’ve used the example of revenue, but it could be anything: excitement, pleasure from listening, willingness to drive to see a concert.

What does this mean? It means the margin is in the fat tails.

The Margin is in the Fat Tails, not the Lumpy Middle

Margin, as I’m going to use it now, is the difference between the intrinsic value of an asset and how the market values it.

If you asked someone how much Amanda Palmer’s audience of listeners was worth, most people (including record companies) would have looked at it and said “about $540,000.” That was how much her first CD made, after all.

However, this thinking is the result of the bell curve mental model.

Palmer’s Kickstarter proved that a smaller audience was worth far more — $1.2 million in fact.

People walking around with the bell curve model think that the top 1% of customers, the fat tail, only account for a small amount of the revenue, when they actually account for 50%. And so they spend their time, energy, and attention on the lumpy middle of the bell curve, instead of the fat tail of the 80/20 curve.

Almost everyone systematically under-allocates resources to the fat tails. We tend to spend most of our time and energy thinking about the middle, because we see the world through a bell curve lens, and most of the area in a bell curve is in the middle. But in reality, we live in an 80/20 world, where the top 1% of fat tails account for 50% of the results. The people who understand this seem to know how to attract luck, but really they’ve just adopted the 80/20 curve model.

The difference between how everyone walking around with a bell curve model see the world, and how the few people walking around with an 80/20 curve model see the world, is margin. The fat tail of the 80/20 curve is systematically under-invested in.

By shifting your attention from that fat part of the bell curve to the the fat tail of the 80/20 distribution, you get more margin.

Let me give some examples to explain.

How to Attract Luck: Lessons from Margins in Fat Tails

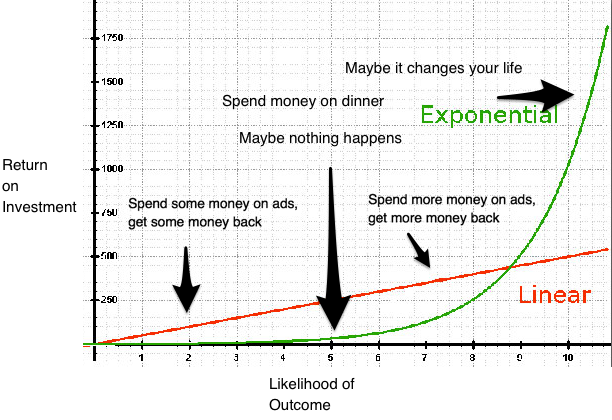

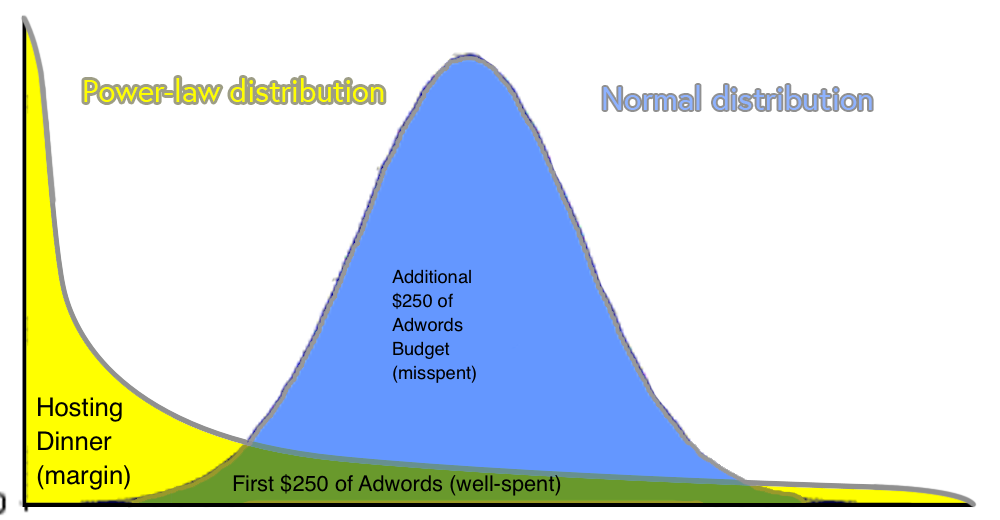

Growing a Business: Let’s say you have $500 to spend to help grow your business. What’s a better investment: would you spend it on pay-per-click ads driving everyone to your products, or buying a group of people in your industry dinner?

Ads is bell curve thinking, hosting dinner is 80/20 thinking.

Your return on ads is linear. You spend $500 and you get $1000. That’s the bell curve. Linear.

Your return on dinner is non-linear. You spend $500, someone introduces you to a friend who eventually becomes your business partner, and you sell the company for $10 million dollars five years later. Sounds unlikely, but the nature of fat tails is that any individual one is unlikely, but done systematically, very likely. I didn’t know which of the two hundred people I emailed about my book would be able to help, but I believed that it was statistically likely that one would.

Though highly unlikely, the outcome is worth it. You only need it to happen once in a career. Would you organize a hundred dinners for an 80% chance of making $10 million?

Again, most people don’t think this way, so you get margin at the fat tail. Most people are focused on the linear stuff, the lumpy middle of the bell curve. If everyone was operating with an 80/20 mental model, there wouldn’t be margin there.

If everyone was hosting dinners all the time, it would be an annoying obligation. “God, another dinner!” But since almost no one does it, you get the reaction, “Wow, dinner, yea that sounds great!”

A perfectly rational way might be to spend $250 on the ads and $250 on dinner.

Indeed, one very good argument in favor of adwords is cash flow. Since fat tails are inherently unpredictable, investing some into things that are likely to work is a good strategy.

You don’t know which dinner will pay off, and in the words of John Maynard Keynes, “The market can stay irrational longer than you can stay solvent.”

The ads keep you alive while you wait for one of the fat tail bets to pay off.

Customer Acquisition: In his essay Do Things That Don’t Scale, Y Combinator’s Paul Graham notes that “[he] ha[s] never once seen a startup lured down a blind alley by trying too hard to make their initial users happy.”

This is 80/20 thinking. Because everyone is operating with a bell curve model in their heads, they are spending the same amount of time and energy taking care of each one of their users. But because not all users are created equal, if they were optimizing properly, they would spend 50% of their time on the 1% of users who are most excited about the product — and being an early adopter is a strong sign of being excited.

Again, there’s an additional margin here. Because most companies treat all their users the same, most of us aren’t used to getting truly exceptional service, so when we do, we tend to tell our friends about it.

Instead of setting up a pop-up, do what Stripe did and write your best customers thank you notes. There’s more margin there.

Reading Books: A difficult book that takes twice as long to read usually gets the reaction, “oh, I could read two other books in that same period of time,” because they have a bell curve model in their head.

Any given book is only marginally better than any other book if you think about books falling on a bell curve, but on the 80/20 curve, a great book could be ten or a hundred times as valuable as an OK or good book.

You can learn more about a field by reading the three foundational books then you can reading the most recent thirty. I’ve met people who say they have “ten years of experience in marketing” and who can rattle off statistics about how blogging frequency affects traffic from the thousands of blog posts they’ve read, but put them up against someone with two years of experience who has read Ogilvy, Hopkins, Halbert, Schwartz and Godin? They’ll get trounced.

Relationships: If you were trying to maximize your personal happiness, you would spend 50% of your time with 1% of your “network.“ Maybe four or five total people. A really great friend will bring you ten times the pleasure of a good friend and 100 times that of a loose acquaintance.

Working Out: If you wanted to get in the best shape possible, you would focus on doing just a few exercises exceptionally well. 1% of exercises account for 52% of results. By getting really good at those, you’ll do better than someone who instead spends their time trying to be “well-rounded.”

Focus on depth, not breadth.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

-Ben Graham

A good rule of thumb for identifying the fat tail in any given system is to think about how to go deep, not wide.

A key reason why all the margin is in the fat tails is because there is no clear cause and effect. The fat tails are profitable in part because they are hard to directly attribute. It’s easy to see how spending $250 on ads can return the money; it’s much harder to see how hosting dinners pays off.

It’s almost impossible to measure depth, but easy to measure breadth.

In relationships, the number of Facebook friends you have is easy to measure, but that number is a horrible metric of anything meaningful. You can have tons of FB friends and feel terribly lonely. Most people do.

In marketing, it’s easy to measure how many contacts are in your database, but hard to measure how much the top 1% are worth.

In books, it’s easy to measure how many books you’ve read, but really hard to measure how much a book impacted your thinking.

Investing more in fat tails means being wrong a lot more, and perhaps this is why the most successful people often say they made a lot of mistakes. They made a lot of fat tail investments, most didn’t pay off, but the ones that did made all the difference.

Last Updated on June 11, 2025 by Taylor Pearson

Footnotes

- Source: Why The Normal Distribution Is Vanishing

- Source: Amanda Palmer raised $1.2m, but is she really ‘the future of music’? (The Guardian)

- Perry Marshall has done work on the implication of this for marketers and entrepreneurs in his book 80/20 Marketing (which predicts Palmer’s results). Recommended reading.

Hi Taylor! Almost done with The End of Jobs and loved this article too. I had read a lot about the effects of 80/20, but your perspective changed my way to see it. I feel I’m to internalize this mental model much better now, thanks.

Awesome! Glad something clicked 🙂

Awesome! One of the most important pieces of wisdom I’ve read all year! Definitely in the 1% category. Sharing with my kids right away.

Thanks Ro!

Good one Taylor….right up my alley!! I can certainly attest to this phenomena materializing. As you said, it’s tough because it isn’t linear-as an investor/trader solely relying on this endeavor as a major source of my income;my bread and butter predicated on the asymmetric payoff.

That’s really interesting. Have never thought about it that way. What do you do (or how do you think) about contingencies. I.e. If a longer than expected flat or down period occurs, do you look for more linear sources to keep the ship afloat?

Yeah….we call it dipping into the kitty, so most important thing is 1) ensuring when the sun does shine, your bailing lots of hay 2) the hay consumption never exceeds the production and lastly 3) in special circumstances where more is required, have easy access to others fields when needed;)

Really well written article, Taylor. Thank you! It gives me a lot to think about in terms of wher eI want to go with my business in the future.

You’ve explained this model perfectly.

Hey Tina,

Awesome! I’m doing a lot of thinking about what it means for me as well.

What would be a good way to cultivate this mindset ?

I recognize the truth in this, and I have several personnal stories that attest to it… and still I don’t think I’m fully implementing it in my day to day.

When distributing resources, I tend to focus on a clear cause to effect relationship, which means my plans tend to be linear.

The first step will be to add this article to my «re-read at the beginning of each planning cycle» list.

Is there a specific question / thinking exercise that you find useful to prime yourself to think this way ?

An answer to my own question came to mind.

I heard this on the Tim Ferriss show recently (I think it comes from Peter Thiel originally) :

“How could you hit your 10 year goal in the next 6 months ?”

That’s an interesting prompt. Adding it to my list 🙂

I find that I can often feel value in a visceral way even if I can’t ascribe a number to it. I.e. When I get a good group together and everything clicks, I can feel a ton of value was generated even if I don’t see how it will pay off.

Dan Andrews had a post a few years ago that said something to the affect of “Entrepreneur’s chase value not cash.” I think that mostly gets at it.

But, in some sense, the margin is there because it’s so hard to do.

“Entrepreneurs chase value not cash” => awesome !

Well written Taylor. Very useful mental model to carry around. You really made it more relevant with examples. Keep up the great work.

Thanks, glad you enjoyed it!

When I first started reading this, I thought that it was contradicted by companies like Microsoft, Facebook, Walmart, FedEx, etc where the value results precisely from having such a huge number of users. But then I remembered that these businesses had to start somewhere and initially they would have depended more on doing things that didn’t scale. And also that business writing focuses too much on these household name companies when there are many more companies that operate on the principles you’ve described, including enormously valuable companies like the construction giant Bechtel.

Re: Same examples – truth. I try to bring up new companies but I get why people don’t do it (you have to explain the whole back story)

I do also think that even in standard examples you could find these principles at play if you got the full story

Great article Taylor. Though I disagree about what you said about relationships and working out.

Relationships, it’s a bit contradictory to what you said earlier in the post – you emailed 200 people about your book, but then circle back and say that you should spend most of your time with 4 or 5 people. Same with spending $500 on dinners. Keith Ferrazzi in “Never Eat Alone” says the power of networks come from acquaintances (people you know only somewhat), not from close friends or family, and it’s definitely true in practice.

Working out, you have the right idea that less can be more, except it doesn’t necessarily mean doing fewer exercises but rather working out less – but smarter – can make a difference. I think doing only the same exercises causes one to reach a plateau, and there are thousands of muscles in our bodies that we don’t use.

Nice article overall.

Re: Relationships – depends how you label the axes. If you label for fulfillment, spending more time with fewer people is probably better. If you label for business stuff, loose ties probably matter more.

I love that you’ve used statistics to prove out an unproveable model, but that’s exactly what this perspective is all about. You can’t quantify it. You can’t attribute it. You can’t trace the ROI. But you can see it in the results. And at the end of the day you’re looking for success, not a set of perfect results that satisfy a statistical model from a textbook.

“I love that you’ve used statistics to prove out an unproveable model” – Didn’t think about this way, but yea. Warren Buffett has a line about valuing companies that’s something like “I prefer to be imprecisely right than precisely wrong”

This was super thought-provoking, Taylor. As other commenters noted, 80/20 is something that most of us are familiar with, but few of us practice it and think about it in terms of margin. We’ve just begun investing a ton of resources into marketing our business, and it’s overwhelming. I’m going to schedule a solid brainstorming session on how we can apply this mindset to our marketing, and see how we can think more fat tail than bell curve.

Also, the margin in the fat tail reminds me of one of my favorite short quotes: “There are no traffic jams on the extra mile.”

Love the quote 🙂

But, but you need to know, or know how to find your prime customers are. If this is written for a newbie then surely they would need to apply the bell to get established to a point where they can analyse and find where their customers lie on the 80/20 principle. One would hope an established business would know which of their customers are premium customers and be looking after them already, even if they know nothing about the theory behind looking after your best clients (it’s too freakin logical!).. So who exactly is this article aimed at?

Just found this gem while cleaning out my inbox.

“It’s easy to see how spending $250 on ads can return the money; it’s much harder to see how hosting dinners pays off.”

Would you say that it is actually not that hard too see how hosting dinner COULD pay off, but people just don’t actually BELIEVE that it would and therefore forgo dinner?

Also, do you see any risk in fetishizing 80/20 analysis like NNT says acadamdia does for the bell-curve?

Brilliant article anyway,

Marc.

This highlights a difficult truth… that the key factors for success really come down to grit, persistence, emotional resilience.

The ability to launch project after project, unscalable action after unscalable action, where each has a small %age of being transformative, but most result in nothing.

And the ability to stay the course and keep executing on high-upside-bounded-cost actions. Maybe through weeks/months/years of minimal results.

To constantly override your own dopamine/reward systems and stick with the long-term plan. In Psychology they call this “Executive Function”.

That optimal mix of stick-to-it-ive-ness, delayed gratification, and flexibility to launch and complete many experiments, each with small chance of high upside.

It’s also the trait that (the few!) successful daytraders have in abundance.

Seems like it might THE key factor for success in “Extremistan”.

Great article, Taylor. The Pareto principle is something I am very familiar with and I heard about the fat tail application, though it is not something that I am thinking through and applying in business applications; it is definitely on the list now! Thanks